Governor hopeful Crouch fleshes out proposals on Tax Day

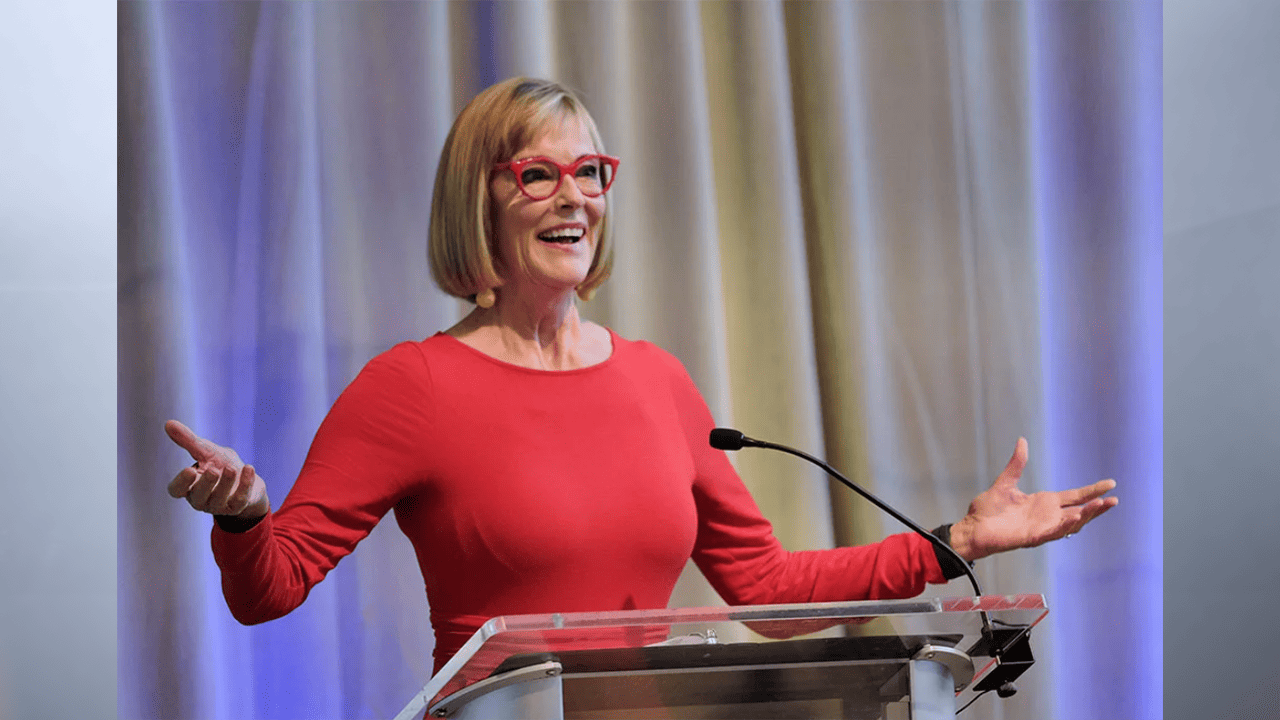

(INDIANA CAPITAL CHRONICLE) — As Hoosiers finalized their taxes on April 15, otherwise known as Tax Day, Lt. Gov. Suzanne Crouch shared specifics on her ‘Axe the Tax’ plan and additional ways she wants to save taxpayer dollars.

Crouch’s proposal to eliminate the state’s income tax — already set to be one of the lowest in the nation for state’s that have one — has drawn criticism for the $8 billion gap it’d leave in the state’s budget. But the campaign has repeatedly insisted that state government could be more efficient and cutting the income tax would be incremental.

“My focus as Governor will be to create a better quality of life as we put more money back in Hoosiers’ pocketbooks, provide safety in our communities, invest in education and our workforce, and streamline state government for the most efficient investment of our tax dollars,” said Crouch.

The Tax Day release includes some previously shared ideas — including combining or reducing some state agencies and auditing “major” agencies, such as the Family and Social Services Administration (FSSA). FSSA revealed a $1 billion budget error in the Medicaid forecast in December, prompting the agency to identify savings by curbing the use of an attendant care program for parents of disabled children and a waitlist for skilled nursing care.

Crouch, who leads a task force analyzing state policy on service for disabled Hoosiers, has harshly criticized the agency for its cuts and first called for an audit back in early February.

One suggestion could combine various workforce programs across five different agencies into one, dubbed the Indiana Department of Education & Workforce, creating “one efficient Hoosier friendly agency that will guide each Hoosier child from early learning to the job market.”

“When we consolidate our education and workforce agencies into one, we will work in tandem to prepare every child for the next step in life whether it is enlistment, employment, enrollment or apprenticeship,” said Crouch. “Then we will be able to put more money back into the classroom.”

But the release included new details as well, including a plan to provide better customer service and navigators for state government agencies.

On the customer service side, a “permit payback program” would require state agencies to refund application fees if those aren’t granted to Hoosiers in a timely manner — modeled after a similar program in Pennsylvania. State-hired “navigators” would provide a “more personal accessible entry point to help Hoosiers navigate the often-complex system of state government.”

The release notes that each agency, and its various field offices, have unique numbers and are often confusing to understand.

Combined, she said the savings would allow the state to pursue her income tax cut proposal. But she didn’t provide an estimate for any of the savings.

“By proper oversight to limit government growth, end wasteful spending, and find efficiencies, we can create a 21st century government for a 21st century economy. We will provide real savings so we can axe the state income tax and give Hoosiers more of their hard-earned money back to them,” Crouch concluded in the Tax Day release.